Long term asset planning

A major player in the Oil & Gas market owns a mammoth size petrochemical facility. The facility includes dozens of processing plants (such as Aromatics, Ethylene and Chlor Alkali) and several auxiliary units (such as cooling water systems, process pipes, flare systems, raw and demin water units, bagging units and more). The facility's age ranges from numerous years to multiple decades.

The challenge

Despite quite some investments in the past, the management was interested in receiving the following before any significant decision:

- a comprehensive assessment of the As-Is condition

- short to long-term improvement scenarios per each plant/unit

- a long-term (+20 years) perspective of required investments on (ageing) assets.

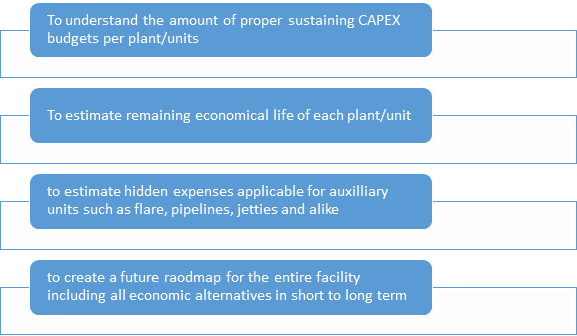

Highlights of the scope of work included but were not limited to the following inquiries:

The constraint

Dozens of major and minor project objectives had been listed carefully in the scope of work. At least 250 major pieces of equipment, each valued at least $1m, were supposed to be carefully studied. Subject-Matter Experts from all disciplines were required to be involved and to report their observations. Besides reliability and integrity, any HSE and Process Safety findings were asked to be elaborated. The expected cost estimation accuracy was set to ±40%.

Furthermore, the whole project was expected to be executed in less than six months within a lump-sum budget. A major hurdle was that not all documents and records were up-to-date and missed the required quality.

Staff transparency and openness, which are typical constraints in such projects, were no problem at all. The client staff was willing to share their views and information and demonstrated an exceptionally high desire to improve the accuracy and precision of the study.

The solution

To solve this challenge, Stork quickly formed a multidisciplinary team with Fluor, including Subject-Matter Experts (SME's) from Static, Structure & Materials, Civil, Rotating, Electricals, Instrumentations, Turnarounds, Maintenance and Process engineering disciplines. This team paid multiple visits to all corners of the facility, interviewed the client stakeholders in different layers and disciplines, studied documents and historical records, and analyzed asset conditions from reliability, process, mechanical integrity, process safety and engineering economy viewpoints.

Wherever improvement was required, depending on the plant nature and product portfolios, the project team proposed and discussed more than one alternative solution with the client, as illustrated in the figure below.

Figure 1: Multiple options have been generated based on the plant's remaining lifetime

The client selected the most suitable alternative for each plant/unit. Then the Stork-Fluor team captured calculated annual investments per each alternative and formed the future roadmap with a 25-year horizon. This future roadmap illustrated multiple asset investment plans, including total required investments, Net Present Values and Internal Rate of Return. We completed the future roadmap by adding our SME's short to long-term recommendations and presented the complete package to the client.

The project team identified three processing plants that do/will not operate economically and suggested them for complete renewal. The Civil and Structure & Material SME's submitted a constructability addendum for these plants.

Stork and Fluor are pleased that the outcomes of this intensive high-demand project met client satisfaction.

Stork’s Predictable Plant Solution

This project scope is part of element 4 of Stork's Predictable Plant Solution: Asset Life Cycle Analyses & Plan (Figure 2).Figure 2: Stork's Predictable Plant Solution - Element 4

Explanatory notes on Stork's Predictable Plant Solution

Elements 1 & 2 are the “non-negotiable” fundamentals almost in every processing plant. They are there to ensure the process remains safe to people and to the environment, complied with regulations. By element 3 (Asset Reliability Management), the company will strive to optimize the asset performance versus risks and expenses. Element 4 promotes applying the engineering economy fundamentals on proposed investment scenarios to understand their return on investment and payback time before making decisions. By element 5 (Asset Management Strategy), we consolidate and align strategies proposed within the previous elements with each other. Finally, by the 6th element, we reach out to other disciplines such as HR, Finance, Supply Chain Management and Energy Management to align objectives towards a sustainable and responsible operations.